- 体系化求职课程,覆盖四大/投行/咨询/金融/快消/互联网/房地产等热门行业

- 500强名企大咖导师,手把手指导实操细节

- 行业硬技能全覆盖,增加简历含金量

- 名企实习直推打造高品质履历,助力目标名企Offer

项目安排

- 24hours

泛金融实战演练:内资券商IPO,外资投行前中后台;战略管理咨询,四大审计/税务,基金财务管理

- 18hours

Fintech技能提升:Excel进阶版实战技能操练,VBA/Python数据信息处理,Python/Tableau数据可视化操作

- 6hours

1 V 1 面试模拟及反馈:1 V 1 简历修改+个人核心竞争力提升+软实力训练

- 5+ hours

个面、群面、经理面等特定职位多次一对一定制辅导

- 国内保Offer

国内内推资源:保证外资投行/券商/咨询/500强全职工作Offer

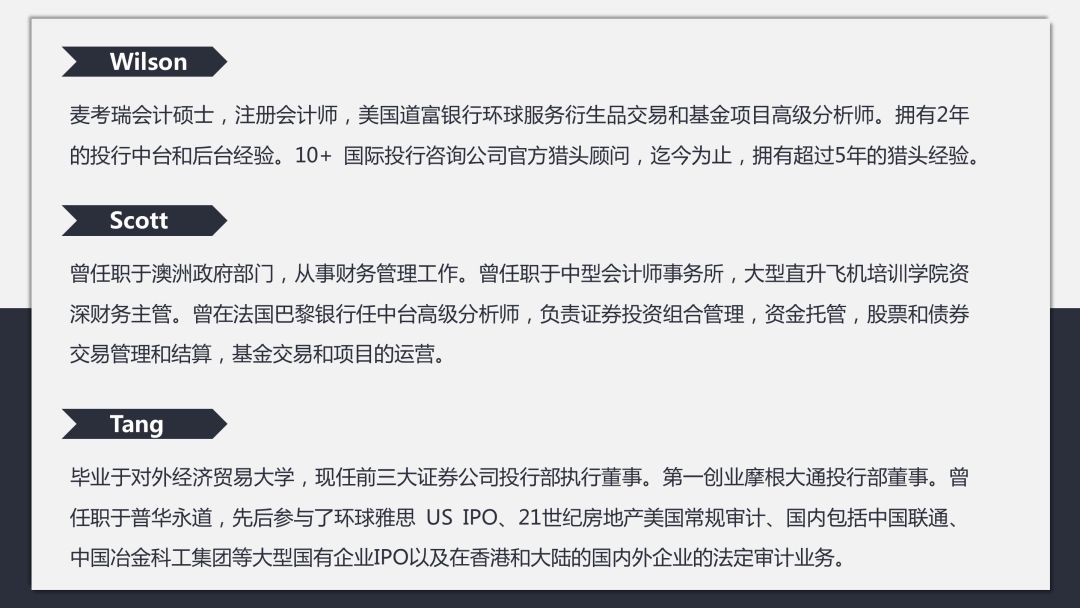

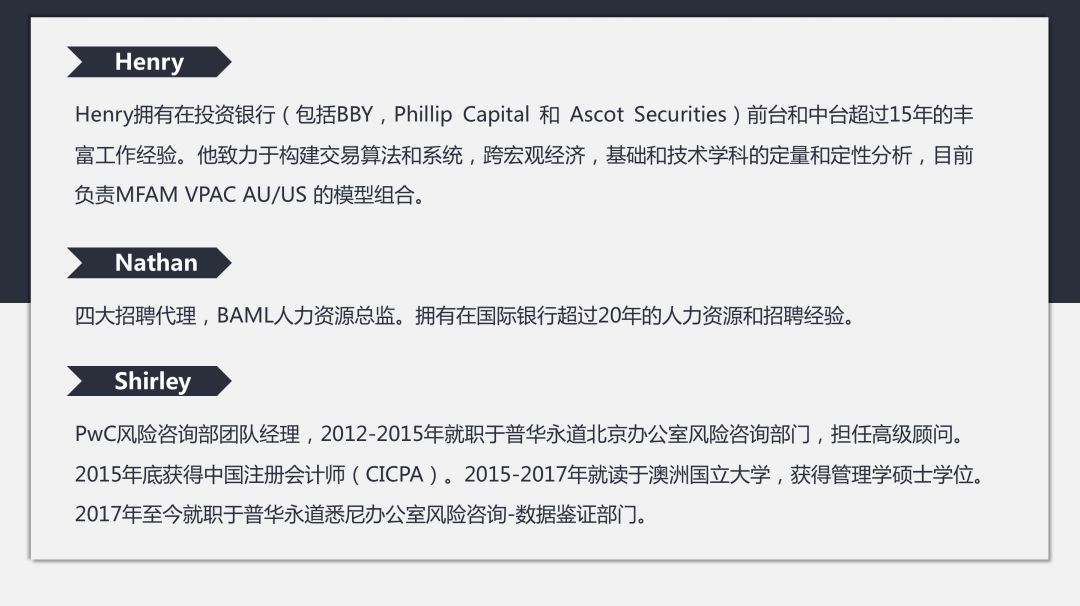

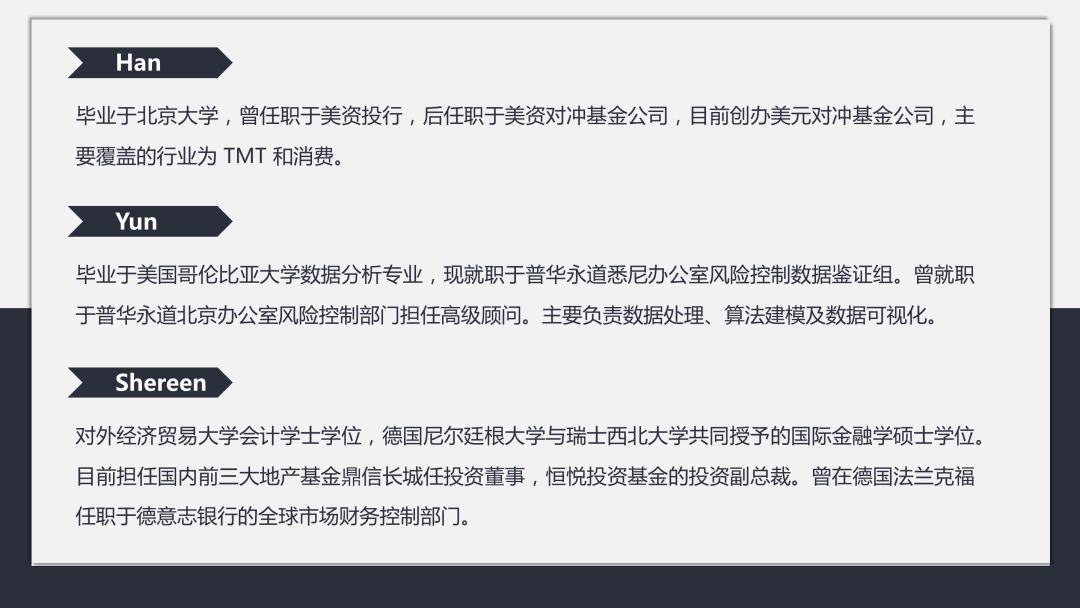

精英导师团队

职拓将根据前期导师模拟面试+职业规划的评定结果,对学生的后续培训课程进行定制化修改及调整,因此每个人的服务具体课程会有所不同。

- 阶段一

个人求职能力评估(导师模拟面试)+职业规划档案建立

学员提供真实教育背景及目标求职行业及岗位(四大、咨询、投行、券商、金融、快消、互联网、房地产etc.);求职目标地域规划(中国、澳大利亚、英国、美国、香港etc.);实习经历有效性(根据实习经历的含金量以及同目标行业和岗位的匹配程度而定)。职拓将为其进行定制化培训课程设计:

Industry Landscape 行业全景解析(解决学员职业规划迷茫全套问题);Industry Insights & Trend 如何选择适合自己的目标行业

- 行业解析:热门行业薪资及就业趋势解析

- 岗位选择:细分岗位职业发展路径规划及招聘偏好

- 岗位技能:如何规划学习岗位所需硬技能

- 长线规划:如何利用自身优势规划最有效的职业路径

- 简历打造:中英文简历逐字逐句修改 Resume Tailor & Critique + Linkedln Profile Review & Editing 领英档案细致检查

- 阶段二

有效+高质量实习

有效实习/项目是背景提升以及转型的利器,极大提升简历综合打分以及网申过筛率,严选合作企业以及合作实习/科研项目。一份高含金量的实习,意味着什么?名企与世界500强的敲门砖;让HR眼前一亮的履历;面试时侃侃而谈的资本;你的职业道路上新的台阶。

- 阶段三

定制化课程岗位夯实(求职关键能力),系统解决岗位关键能力缺失问题

行业资深导师将根据前期对学员的能力测评及高质量的实习背景,强化学员对岗位关键能力的理解与提升(Problem Solving Skills、 Data Analytics、 Product Insights、 Logical Presenting、 Time Management etc.)

- Key Capabilities & Job Description 针对岗位的关键能力解析:对目标岗位进行关键能力细分拆解,从而对关键能力进行点对点提高

- JD解读:细分目标行业岗位与职业路径解析

- 笔试题库:职拓独家近几年真题整合

- 关键能力:(以Problem Solving Skills为例)Case Structure & Business Sense系统性训练

- 阶段四

面试技巧一对一极速提升

基于全球企业招聘流程更新OT(HireVue AI 笔试)+ 单面 + AC面/ Superday /群面 + 合伙人(M/P 面试)单面必杀能力提升,梳理理念笔面试题库,汇总分类。

- Individual Interview 单面必备:精英导师提供面试题库解析

- Self-Pitch 自我介绍:1/2/5分钟自我介绍赢得好感与关注

- Follow Up Questions 提问技巧:如何巧妙提问提升面试好感以及效率

- Networking Strategy 套词策略Cold Call / Networking:如何通过领英邮件以及人脉网络搭建策略获得更多内推机会